If you know you're going to buy a home in the next year, check your credit report now. Your mortgage lender will check your credit score very early in the process, so be sure you know where you stand before you start looking for a home. In general, the higher your credit score, the better the interest rates you'll qualify for. You also want to avoid taking out new debt, such a car loans or credit cards, once you're in the homebuying process. Paying debts on time and paying down balances can improve your credit and your debt-to-income ratio - something lenders look at when they qualify you for the loan. That's another reason to stay within your budgetary boundaries. You'll also need to establish an emergency fund for unexpected repairs that pop up from time to time. Homeownership comes with a variety of potentially new expenses, including furniture, monthly utilities, home insurance and property taxes, so don't forget to factor in those items.

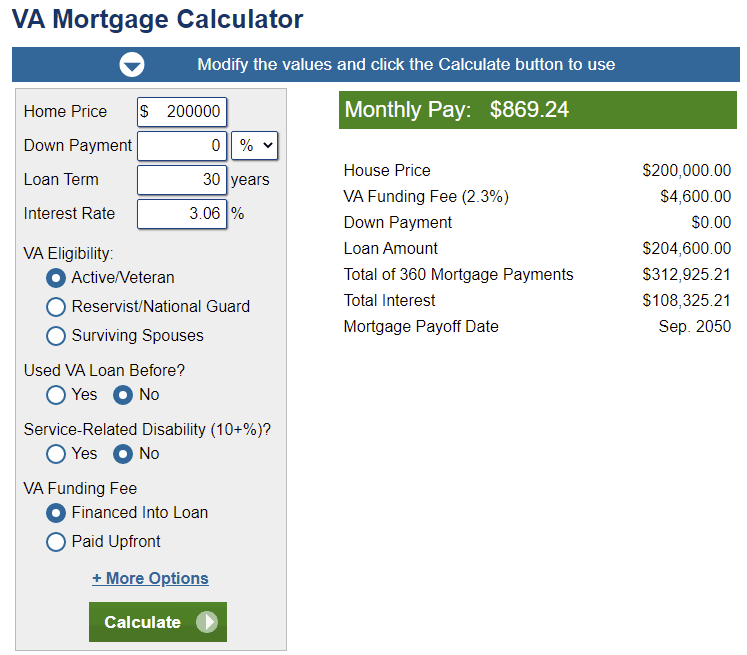

So make sure you choose a loan amount that leaves you both comfortable and able to meet your other financial obligations. It's easy to start shopping for a home and fall in love with a property outside your price range. Once you've established what you can afford, stick with your plan. Be sure to include all parts of a mortgage payment, including principal, interest and at least an estimate of property taxes and homeowners insurance. To quickly get an idea of how much payment comes with a specific loan amount, using a mortgage calculator can be a helpful tool. If you're currently renting, what are you paying? Another guideline, but not a hard rule, is to keep housing payments within 28% of your take-home pay. The first - and perhaps most important - question you need to ask is " How much house can I afford?" Start by looking at your monthly budget to see what sort of payment can fit comfortably. Here are some tips to make the process smoother and more efficient. With some common sense and trusted guidance you can get there, too. We hope you found this information helpful! It may even afford you the upper hand when multiple offers are on the table. When you are preapproved, you'll be able to make an offer on the home you want with confidence, knowing that it's within your price range.

Get Preapproved Īnd finally, get preapproval for your mortgage. A home that looks wonderful by day may look quite different in the evening hours. Familiarizing Yourself with the Desired Neighborhood īe sure to drive by the property you're interested in at different times. There's a lot at stake here, so you want to select an agent that is trusted, licensed, reputable and experienced in all of your needs and wants in buying a home. You'll also need to leave yourself a cash reserve beyond what's required to get into the home to be ready for other unforeseen expenses. There are loan options that require as little as 3% down, or 0% for eligible service members and veterans, but a 20% down payment could save you money by eliminating potential cost of private mortgage insurance on conventional loans. Factoring a Down Payment Into Your Budget You can simplify your search and save time and effort. Identifying Property and Neighborhood Desires ĭefine your desires early in the process, like neighborhoods, school districts, walkability and other things. These are things lenders look at when they qualify you for the loan. You also want to avoid new debt once you're in the home buying process. Paying debts on time and paying down balances can improve your credit and your debt-to-income ratio and help lower your interest rate saving you thousands of dollars. Managing and Maintaining Your Credit Score Don't forget to factor in all of the extras that come with home ownership like furniture, monthly utilities, home insurance, property taxes and unexpected repairs. You may be preapproved for a higher mortgage amount making it easier to fall in love with a property outside your price range, but stick to your budget. What you currently pay for rent or 28% of your gross monthly income and Mortgage Calculators are all great places to start in determining how much house you can afford. You want a mortgage payment that fits comfortably with your lifestyle. So, you're buying your first home? Here are few tips to make this exciting process run smoother.

0 kommentar(er)

0 kommentar(er)